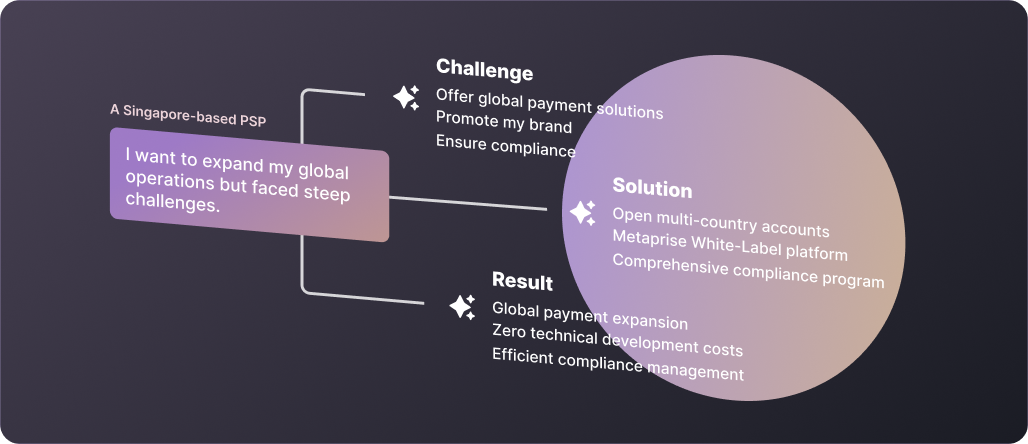

A Singapore-based Payment Service Provider (PSP) sought to expand its global operations but faced steep challenges in managing technical development, compliance, banking partnerships, and licensing—all critical for entering multiple international markets. Traditional solutions, while robust, often require significant upfront costs for customization, development, and compliance, creating barriers for smaller PSPs aiming to scale quickly.

The Challenge

The PSP's main objectives were to:

- Offer global payment solutions by opening multi-country accounts across key markets.

- Launch a fully branded platform with minimal operational costs, without investing in development or acquiring expensive licenses.

- Ensure compliance with international banking standards and regulations without taking on the complexities of managing individual country requirements.

- Form direct partnerships with local banks to support international transactions and real-time cross-border payments without the usual overheads.

The Solution: Metaprise's White-Label Global Payment Solution

Metaprise provided the perfect platform to address these challenges. Using Metaprise’s White-Label Global Payment Solution, the PSP was able to:

- Open multi-country accounts with local banks in key markets, enabling seamless cross-border payments without needing direct banking relationships.

- Launch a fully branded, global payment platform at zero upfront costs, fully customized to the PSP’s brand and tailored to meet local market needs.

- Ensure regulatory compliance through Metaprise’s license coverage and compliance infrastructure, allowing the PSP to operate across multiple regions without handling complex legal requirements themselves.

- Integrate with global payment networks (e.g.,ACH, SEPA, and Faster Payments) and real-time cross-border transfers, all while optimizing transaction processes and reducing costs.

The Result

Through Metaprise’s solution, the Singapore-based PSP achieved:

- Global payment expansion with multi-country account setup, offering clients a smooth experience in handling payments across multiple regions.

- Zero technical development costs: The PSP launched its platform without any initial investment, leveraging Metaprise’s infrastructure for immediate market entry.

- Efficient compliance management: Metaprise took care of licensing and regulatory issues across regions, allowing the PSP to focus solely on growth.

- Faster onboarding of merchants: With the ability to manage international transactions and secure local accounts in multiple countries, the PSP grew its client base rapidly in Southeast Asia and beyond.

By leveraging Metaprise’s white-label solution, the PSP could scale rapidly across global markets, avoid licensing costs, and operate efficiently with local banks, all while providing a fully branded, seamless payment experience for its customers.